Expertise

Our professional experience mainly lies within the Private Equity environment. We gained our knowledge, in-depth interest and enthusiasm for this sector amongst others by having worked for a private equity company where we built a new division providing fund & regulatory services to the alternative investment fund industry, including private equity firms and real estate investment funds. Continuing this private equity journey in the role as a headhunter, our developed knowledge and expertise typically adds value to the search and selection of the best candidates for our clients. Especially, seen the complexity of this alternative investment class from both an investment process as well as a regulatory perspective, its understanding is key to being able to find and speak to the right professionals for the job.

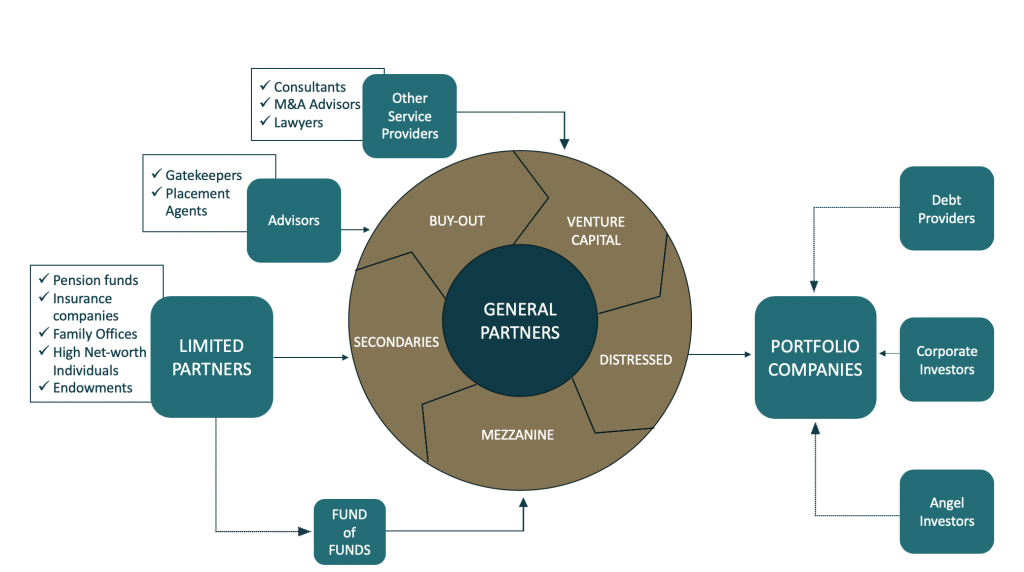

As the private equity landscape includes various stakeholders, such as M&A advisors, family offices and corporate investors, our working field goes beyond the search of solely professionals working at a private equity firm as such.

Throughout the whole investment process, as from the sourcing of the deal until exit, various professionals need to provide their specific knowledge in their field. This means that the right professional needs to be deployed at the right place and at the right time.

Linking talent to value

For example, part of the due diligence is identifying and selecting the right management team of the (future) portfolio company as this is key for a successful exit. The management team is one of the biggest drivers of performance. Based on the outcome, new management might need to be hired – preferably professionals having typically experience working with private equity.

Our network typically consists of:

[1] Finance professionals

[2] Investment professionals

[3] Legal, regulatory & compliance professionals